Running a business comes with inherent risks, and it's essential to protect yourself and your company from potential liabilities. One of the key insurance policies for businesses is general liability insurance. This article explores the significance of general liability insurance, its coverage, and why it is a vital safeguard for businesses of all sizes.

Understanding General Liability Insurance:

General liability insurance is a type of insurance coverage that protects businesses from a range of potential liabilities arising from their operations. It provides financial protection in the event of bodily injury, property damage, or personal injury claims made by third parties.

Coverage Offered by General Liability Insurance:

Bodily Injury Coverage: If a customer or visitor suffers physical harm on your business premises or due to your business operations, general liability insurance provides coverage for medical expenses, legal costs, and potential settlements or judgments.

Property Damage Coverage: Accidental damage to someone else's property caused by your business operations or employees is covered under general liability insurance. This includes repair or replacement costs for damaged property.

Personal Injury Coverage: Personal injury refers to non-physical harm caused by your business, such as defamation, libel, or slander. General liability insurance provides coverage for legal expenses and potential settlements or judgments in such cases.

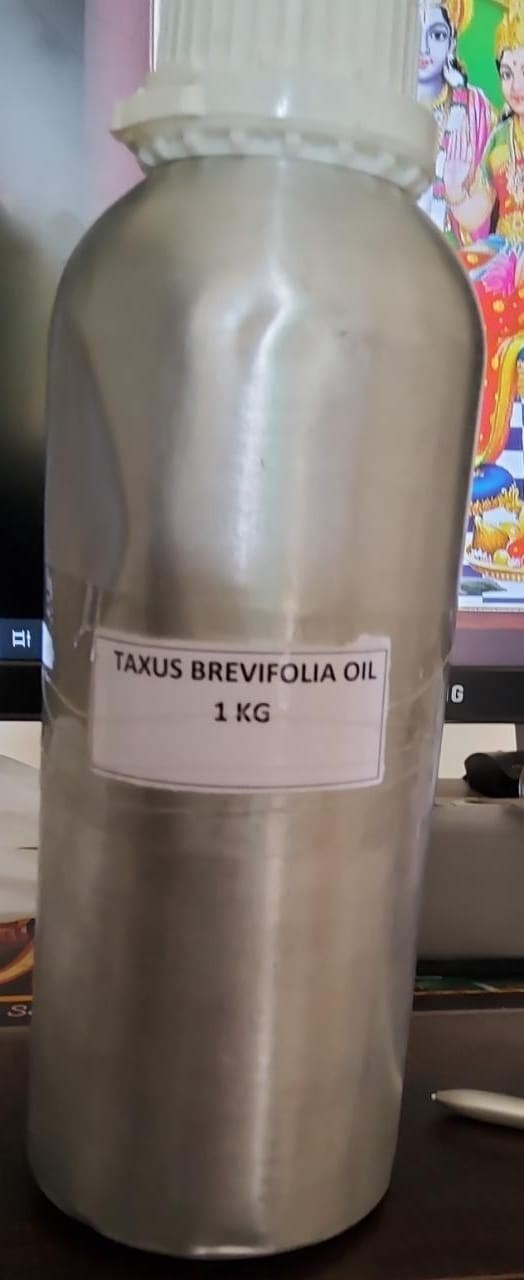

Products and Completed Operations Coverage: If your business manufactures, sells, or distributes products, general liability insurance protects against claims arising from injuries or damages caused by the use of your products. It also covers claims related to services provided by your business.

Advertising and Personal Injury Coverage: General liability insurance covers claims related to advertising practices, such as copyright infringement, false advertising, or reputational damage caused by advertising campaigns.

Importance of General Liability Insurance for Businesses:

Financial Protection: General liability insurance offers financial protection against potential liabilities and claims that can arise from accidents, injuries, or property damage. The costs associated with legal defense, medical expenses, and potential settlements or judgments can be significant. Having insurance coverage ensures that your business has the necessary funds to address these expenses.

Legal Compliance: Depending on your jurisdiction and industry, general liability insurance may be a legal requirement. Compliance with insurance regulations helps avoid penalties, fines, or potential legal consequences that may arise from operating without proper coverage.

Client and Partner Requirements: Many clients, vendors, or business partners require proof of general liability insurance before engaging in business relationships. Having this coverage demonstrates your commitment to protecting their interests and can enhance trust and credibility in the marketplace.

Peace of Mind: Running a business is already a complex and challenging endeavor. General liability insurance provides peace of mind by mitigating the financial risks associated with unforeseen accidents or lawsuits. It allows you to focus on your core business operations without the constant worry of potential liabilities.

Reputation Management: In the event of an incident, having general liability insurance shows that you take responsibility for your actions and are prepared to address any resulting claims. This proactive approach can help protect your reputation and maintain positive relationships with customers, suppliers, and the broader community.

Conclusion:

General liability insurance is a vital component of any comprehensive risk management strategy for businesses. It provides financial protection and peace of mind by covering potential liabilities arising from bodily injury, property damage, personal injury, or product-related issues. By securing general liability insurance, businesses can mitigate potential financial losses, comply with legal requirements, and demonstrate their commitment to safeguarding their customers, employees, and stakeholders. Investing in this important coverage is a wise step towards protecting your business and ensuring its long-term success.